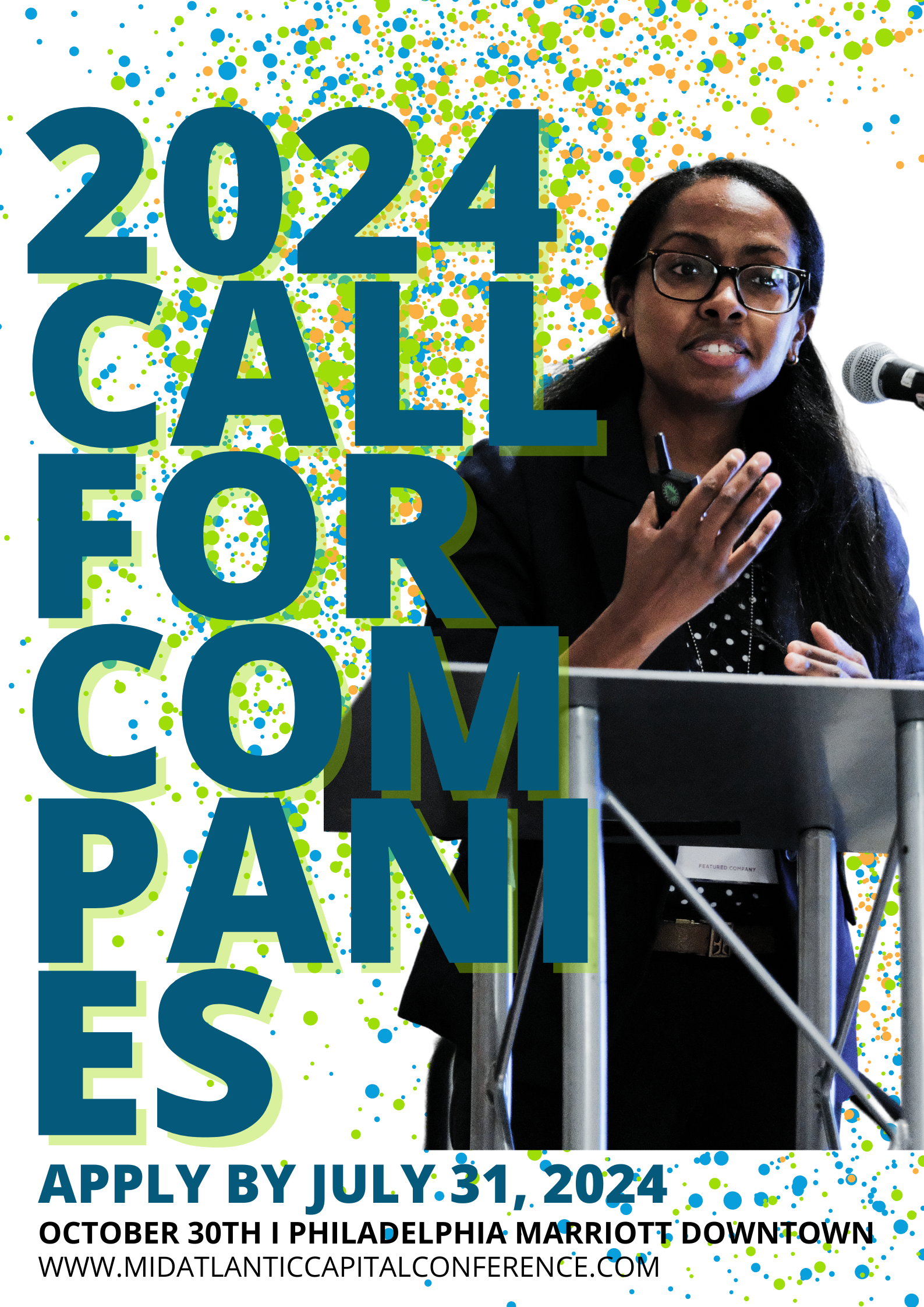

MACC Call for Companies 2025

Calling All Startups!

Apply now to pitch at the Mid-Atlantic Capital Conference—connect with top VCs, angels & corporate investors!

🔹 Tech, Healthcare, & Growth Stage companies

🔹 Just 12–14 spots per sector

🔹 Deadline: July 31st