Businesses facing financial pressure should choose smart over fast

Today’s business climate is defined by uncertainty. Facing tariffs and a fast-evolving regulatory environment, many business leaders feel the need to respond with swift, decisive action.

Action is a good thing. But while speed does matter, it’s even more important that when you act, you do so with a clear sense of your direction based on accurate data and thoughtful scenario modeling from your finance team. Otherwise, you risk making reactive, short-term choices that will ultimately harm your organization’s long-term health.

As you consider your strategy heading into 2026, here’s what you should keep in mind.

1. Slower decisions beat flying blind

The fastest decision may not be the best one. Before you start making any big calls, you need to understand where your cash is going, what’s helping or hurting your profitability and what your financial projections look like under worst, middle and best-case scenarios.

If you don’t have cash flow visibility and financial modeling, you risk flying blind. That’s especially likely for mid-market businesses, as many companies still rely on disconnected systems, manual reports and lagging indicators.

To navigate uncertainty, the future matters more than the past. What happened last quarter is less important than what could happen if a key customer leaves, product demand shifts or interest rates go up.

In other words, you need to consider what big strategic decisions could mean for your finances before you make them.

2. Pressure reveals cracks in your systems

When money is pouring in, you probably won’t notice flaws in your systems. It’s only when profitability dips that you’re forced to confront how inefficiencies, delays and poor data integrity are holding your business back.

To assess the health of your systems, consider questions like:

- How much time does your team spend closing your books each month?

- Do you rely on spreadsheets to run what-if scenarios or use faster, more efficient software?

- Is your team aligned on KPIs and working toward a single overarching goal?

When close cycles are too long, it’s often a symptom of deeper problems like outdated software, disconnected data sources or an overburdened finance and accounting team. In some cases, it’s all three.

Once you expose these gaps in your systems, then you can take action to fix them.

3. Clarity gives confidence

Uncertainty can feel paralyzing. Many leaders are understandably afraid of making the wrong move. But this fear can not only drive hasty action but also lead to equally damaging indecision.

Clarity, however, gives you the confidence to make wiser decisions. To get that clarity, you need to :

- Build live dashboards rather than relying on static reports.

- Integrate your ERP and CRM systems to create a unified source of truth.

- Forecast multiple future scenarios, not just the outcome you think most likely to occur.

- Get your entire leadership team aligned on shared company financial goals.

Rather than focusing your finance team on reporting on what’s already happened, flip your perspective. Your finance team should help steer decisions about what happens next.

That shift takes more than updated dashboards. It requires a mindset change across the leadership team — from viewing finance as compliance to treating it as a strategic partner.

How to make your finance team a strategic partner

In practice, how can you make your finance team more of a partner in key strategic decisions? Here are some examples to consider:

- Manufacturers should ask their finance team to work with operations to model the costs of potential supply chain delays.

- Professional services firms can use finance teams to model project staffing against margin goals for smarter resourcing decisions.

- SaaS companies could try linking customer churn data to revenue forecasting, to avoid being blindsided by subscription losses.

Regardless of your sector, also consider steps like:

- Outsourcing reconciliations, close and other transactional tasks to free up your internal bandwidth.

- Upgrading your tech stack to integrate your ERP, CRM and FP&A platforms.

- Upskilling your finance team to do more financial modeling rather than just compliance and reporting.

An empowered finance team is a catalyst that helps your leadership move faster and smarter. This sort of insight-driven action will typically lead to both improved outcomes and less risk.

4. Better visibility is also a competitive advantage

Choppy financial seas may make you want hunker down. But investing in better visibility now will give you a competitive advantage — because other businesses in your market are likely focused on waiting for the storm to pass.

Consider how two different example firms approach an economic downturn:

- Company A decides to turn to cost-cutting in the face of a tough economy. It lays off people from the sales team and slashes marketing spend — only to realize, too late, just how badly those cuts will reduce pipeline volume.

- Company B takes a more thoughtful approach and runs multiple models before deciding how to act. Based on those models, it’s leadership that they can reduce go-to-market spend by 20% and still protect their growth targets.

Which one of those two companies would you rather be? Firms with better visibility:

- Invest smarter bymaking capital decisions based on maximizing ROI.

- Cut more effectively by knowing the difference between critical and nonessential spending.

- Adapt faster by acting based on facts rather than fear.

By basing decisions off of data and analytics gleaned from a single source of truth, mid-market companies can replace guesswork with intelligence. This helps leaders focus on what matters most — even when the pressure is high.

Where should you start?

If your business is feeling financial pressure, here’s how to start giving your team the visibility you need to make smarter decisions:

- Inventory your reports: Are they forward-looking or backward-looking?

- Map your systems: Are finance, operations and sales working from the same data?

- Run a scenario: If you see a sudden 15% revenue dip, what does that mean for your cash flow?

- Ask your finance team: What tools do they need to provide real-time insights?

You don’t have to fix everything at once. Start with the data you have, then build from there.

How Wipfli can help

Get the visibility you need to make smarter business decisions. Ask us to assess your needs, upgrade your systems and even take day-to-day financial work off your plate to help you turn pressure into clarity. Start a conversation.

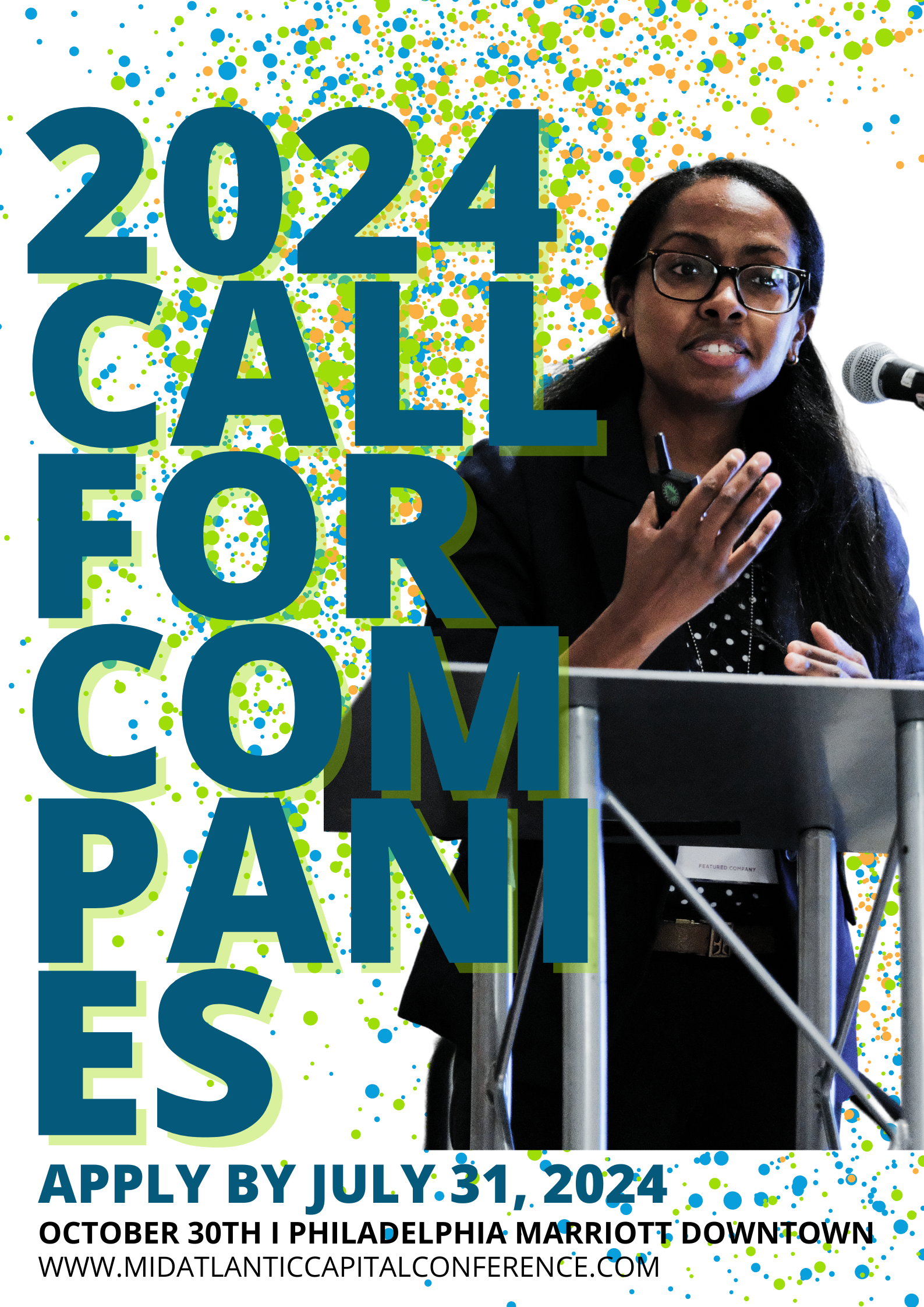

Learn more ways on how you can get connected to companies, thought leaders, and business networking.

Learn about PACT Membership and see upcoming events for investors and entrepreneurs in technology, healthcare, and life sciences. Plus – get on PACT’s newsletter to stay connected with the latest resources!