Mid-Atlantic Capital Conference

October 29 - 30, 2024

NAVIGATION

For over 30 years, the Mid-Atlantic Capital Conference has been the place where healthcare, technology, and growth stage sectors get their spark and a catalyst for billions of dollars in venture funding and entrepreneurial success. Don’t miss your chance to connect with key players from the private equity, venture capital, and entrepreneurial communities for a vibrant mix of company presentations from 45+ up-and-coming technology, healthcare, and growth-stage companies, tons of networking, business meetings, and panel discussions. Plus, the always thrilling Lion’s Den live investment event where investments will be made LIVE from a panel of legendary investors from across the region.

Philadelphia Marriott Downtown

1201 Market Street

Philadelphia, PA 19107

WHY SHOULD I ATTEND THE MID-ATLANTIC CAPITAL CONFERENCE?

Networking

Develop new business relationships like no other investor conference that can lead to your next investment or funding opportunity:

- Schedule exclusive 1:1 meetings with entrepreneurs and investors

- Experience scheduled networking breaks

- Attend our PACT Fest at the historic Reading Terminal Market

Business Development

Meet the people you need to meet to grow your business and investments.

Expand your business networks through:

- 1:1 meetings

- Ample networking opportunities

- Panel presentations and keynotes on the latest technology trends

Company Presentations

Your next investment or funding opportunity just may be presenting this year!

- See the latest in technology, healthcare, and growth-stage innovation

- Experience the Lion’s Den with live investments made to three companies

2024 Mid-Atlantic Capital Conference Keynote Speaker: Sally Jenkins

2024 AGENDA-AT-A-GLANCE

Video highlights

Check out our playlist of over 45 videos with highlights from past Capital Conference events to see why it’s the premier private equity, venture capital, and investor conference in the Mid-Atlantic.

DUANE MORRIS ENTREPRENEUR SCHOLARSHIP PROGRAM

If you are an entrepreneur building your network and seeking potential investors, the 2023 Mid-Atlantic Capital Conference is where you need to be! A special opportunity has been created providing COMPLIMENTARY registration to the first 80 qualifying entrepreneurs to register and attend the Capital Conference on October 29th and 30th thanks to the Duane Morris Entrepreneur Scholarship Program.

Qualifying Entrepreneurs include:

- Incubator/Innovator

- Early Stage

- Pre-revenue to early-round funding

- 1 to 3 business partners

- 1 month to 3 years in existence

Spaces should have been reserved by October 5th. Once we reach our cap for complimentary registrations, entrepreneurs must pay the entrepreneur conference rate ($255). Please reach out to macc@philadelphiapact.com to see if you qualify and receive the scholarship promotional code.

2024 Steering Committee

EY Host Team

Ryan Murray, Chairman

Danielle Senour

Jeff Bodle

Morgan Lewis

Technology Recruiting/Selection Committee Co-Chair

Richard Cohen

Duane Morris

Entrepreneur Outreach Committee Chair

Andrew Coll

EY

Entrepreneur Outreach Committee Liaison

Danielle Duchamp

EY

Marketing Committee Liaison

Emily Foote

Osage Venture Partners

Industry Track Vice Chair, Technology

Rick Genzer

Ben Franklin Technology Partners of Southeastern PA

Company Recruitment Analysis

Michael Harrington

Duane Morris

Recruiting/Selection Oversight Chair

Technology Recruiting/Selection Committee Co-Chair

Kathie Jordan

Ben Franklin Technology Partners of Southeastern PA

Industry Track Vice Chair, Healthcare

Douglas Kingston

Morgan Lewis

Technology Content Committee Chair

Marc Lederman

NewSpring Capital

Lion’s Den Committee Chair

Obadiah Sanger

Independence Blue Cross

Healthcare Content Committee Chair

Bharat Santhanam

Newspring Capital

Industry Track Vice Chair, Technology

Bryan Snellman

EY

Healthcare Recruiting/Selection Committee Chair

PACT Team

Sarah Carter

Marketing, Mobile App

Jennifer Cohen

Featured Companies

Heidi Franklin

Investor Outreach

Cheryl Jarvis-Johnson

Conference Director

Dean Miller

CEO

Krista Yerk

Sponsor Engagement, Entrepreneur Outreach

Bronze Sponsors

Activate Venture Partners

Baker Tilly

Centri Business Consulting

CFGI

City of Philadelphia Department of Commerce

EOS Worldwide

Hamilton Lane

Innovation Space

Klehr Harrison Harvey Branzburg

PwC

Silicon Valley Bank

Stephano Slack LLC

Stout Risius Ross

Temple University

University City Science Center

Wells Fargo

Investor

BioAdvance

Broad Street Angels

BullPenn Capital

Darco Capital

Gabriel Investments

Juno Capital Partners

Matterhorn Capital Partners

MVP Capital Partners

Nouveau Capital – Bob Keith

Plain Sight Capital

Rittenhouse Ventures

Robin Hood Ventures

SEMCAP

SRI Capital

Susquehanna Growth Equity

Tech Council Ventures

Community Partners

Ben Franklin Technology Partners of Southeastern PA – Marketing

Delaware Crossing Investor Group

Drexel University – Marketing

Mid-Atlantic – Eurasia Business Council – Marketing

Office of the Dean for Research | Princeton University – Marketing

Philly Startup Leaders – Marketing

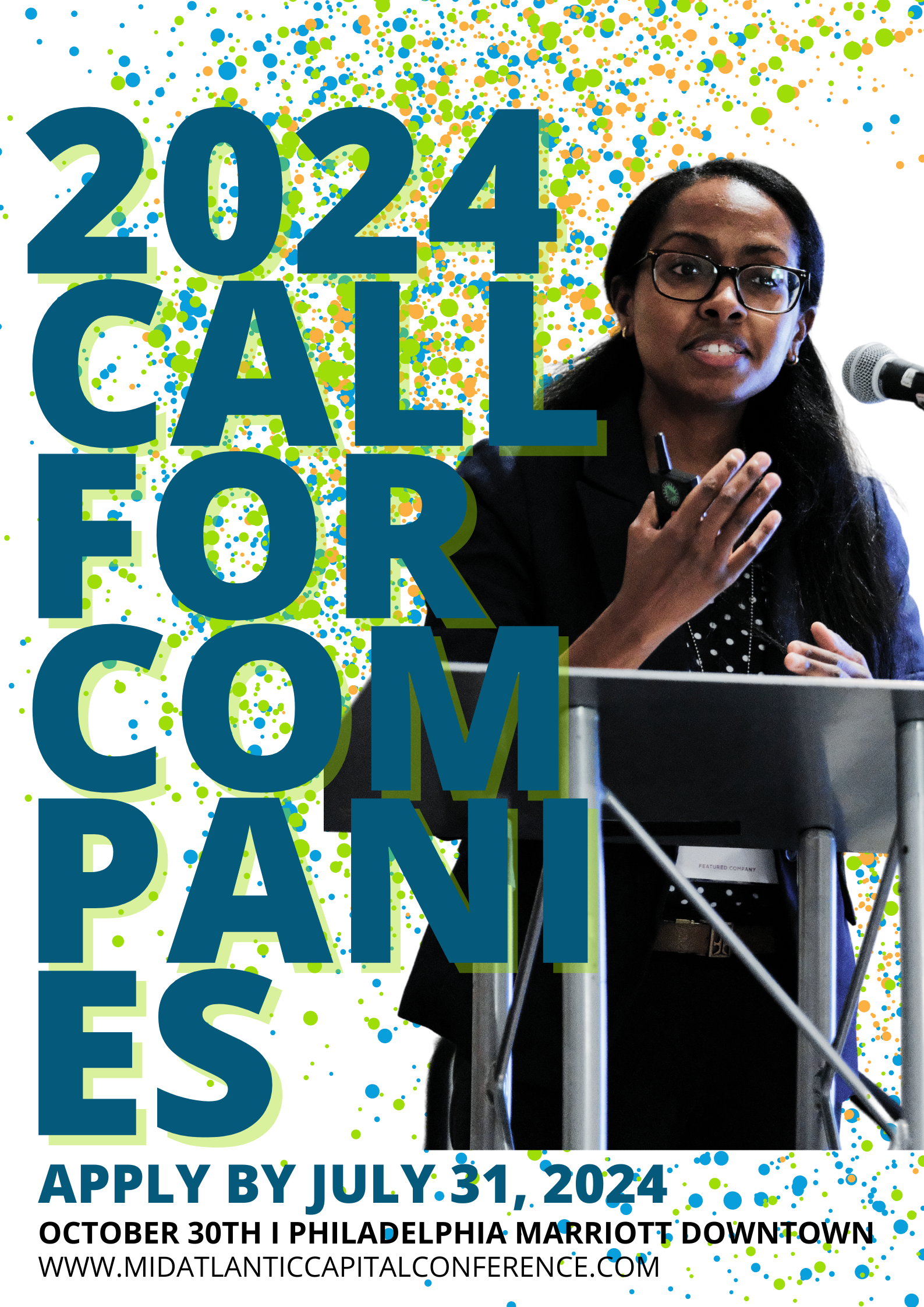

2024 Featured Companies

60+ Early Stage and Growth Stage companies were selected out of over 200 submissions to pitch their innovations live in front of a national base of investors at this year’s Mid-Atlantic Capital Conference.

During pitching hours, featured companies receive direct feedback with hopes of taking home funding, gaining experience and making lasting business connections.

The day’s top companies will enter the Lion’s Den for a shot at on-site commitments from highly successful entrepreneurs turned investors. Over the past 9 years companies, have raised almost $8m in aggregate funding.

Healthcare Companies – Early Stage

3Daughters

ACON Pharmaceuticals

BMI OrganBank

Calla Lily Clinical Care

CleanPAP Co.

Flamingo Therapeutics

Hula Therapeutics

Ilico Genetics, Inc.

KaloCyte, Inc.

Kato Medical Inc.

Lifejoint Orthopedic Solutions

Mag4Health

Medlea

Neurava

Pantheon Vision Inc.

Previse

Prolifagen, Inc.

ReGelTec, Inc.

Regenosine, Inc

Relavo

Ren Bioscience

Trufacial

Vasowatch Inc

Technology Companies – Early Stage

Arcanna.ai

b atomic!

Big Idea, Inc.

Carbon Reform

Circa Systems

Citadel North

CruZen

Ethermed

FairNow.ai

Hyrding

Integrated Reality Labs

KidvoKit Inc.

LeakSignal

Metaversal Learning

Open Admissions

Panga Inc.

Playbl

Praktikant

ReBokeh Vision Technologies

Retain Health

Signum Technologies

Snowstorm Inc.

Strived.io

The Best Answer, Inc.

True ValueHub, Inc.

VirgilHR

Wide Therapy

WireBee, Inc

Healthcare Companies – Growth Stage

American Treatment Network

ARMR Systems, Inc.

Keriton Inc.

Spirovant

Technology Companies – Growth Stage

Acadeum

Humanus

MindPrint Learning, Inc.

Prembly

Returnalyze

SkillCycle

Tunnl

Please note: Final investment commitment contingent upon due-diligence post conference. This is added for selected companies to understand that due diligence is required post conference.

Investor Slide Criteria

- Top emerging companies from the Technology, Healthcare, and Growth Stage (which includes technology and healthcare) sectors

- 16-18 companies per industry to present in the months to come

- All stages of development

We accept company slide decks (no more than 15 slides) and an optional 5-minute explainer video for the selection committee to review. To be considered for a presentation slot, companies should include FULL CONTACT INFORMATION.

Slide Deck Components

Not necessary the slides… but the culmination of the slides should cover the following topics.

- Cover slide: name of company, tagline (if applicable), contact information

- Capital

- Amount raised to date

- If multiple rounds, show history along with types (e.g. institution, friends / family)

- Open round

- If there is a round of funding open, describe

- Amount, type

- 411: Location, Headcount,

- Company vision or mission

- Problem statement, pain point(s)

- Solution: how is the company solving the pain point, product description

- Traction: status of the company, customers, time in market

- Differentiation: what is the competition, how is the company different

- Team

- Market entry: how is the product marketed, what segments are being addressed, what other segments exist

- Sales: how is the product sold, what is the sales cycle, who are decision makers, pipeline

- Revenue model; pricing, what kinds of “contracts” are there (for B2B), model for revenue

- Projections: what are the financial projections

- Years: 2022, 2023, 2024, 2025, 2026 (where applicable)

- Include: Rev, COGS, GM, Earnings

- Numbers in 000,000’s

- Funding Request amount